Entrepreneurs, let’s talk about that paycheck—the one funding both your daily life and your long-term business goals.

If you’re still working a job while building your business, every dollar counts. But here’s the problem: most people don’t realize how much money they’re actually losing before their paycheck even hits the bank.

Paycheck Stub Review

Outline

Where Does Your Money Go? A Pay Stub Breakdown

Before you go looking for a raise or a side hustle, let’s first check if you’re accidentally leaving hundreds of dollars on the table. Because hidden in that paycheck stub could be money you’re missing—money that could be reinvested into your business, savings, or even your personal freedom.

Take a look at your latest paycheck stub. Your gross pay might say one amount, but what actually lands in your account? Probably a lot less.

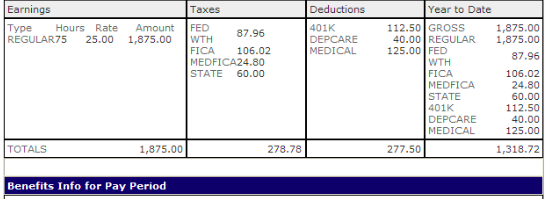

Like the above pay stub for example. The gross pay says $1,875, but net pay of $1,318.72 is what got direct deposited. That’s a huge difference! So, where’s the rest going?

1. The Non-Negotiables: Taxes & Government Deductions

- Federal Income Tax – Based on your W-4 selections, this could be higher than it needs to be

- State & Local Taxes – If applicable in your area

- FICA (Social Security & Medicare) – This is set at 7.65% of your gross pay (no getting around this one!)

Money-Saving Tip: If you’re consistently getting a huge tax refund, it means you’re overpaying. Updating your W-4 form can free up money in each paycheck, instead of giving the IRS an interest-free loan all year.

2. The Optional Deductions: Are They Still Serving You?

This is where you might be losing cash without realizing it.

- 401(k) Contributions – Are you contributing more than you can afford right now? If you’re not getting an employer match, reconsider how much you’re investing versus what you need for your business today.

- Health Insurance Premiums – Do you have extra coverage that might be redundant? Double-check against what your business could provide later.

- HSA/FSA Contributions – Useful for medical expenses, but if you’re not using them fully, you might want to adjust your contributions

- Disability & Life Insurance – If you have separate coverage elsewhere, you might be duplicating costs.

Union Dues or Other Payroll Deductions – Review whether these deductions are essential.

Example: If your 401(k) deduction is $200 per paycheck, but your business is struggling because you lack capital, pausing or reducing it for a short time could free up $400/month to reinvest.

3. The Silent Budget Killers: Convenience Fees

Some deductions aren’t just optional—they’re eating away at your take-home pay unnecessarily:

- Wage Garnishments & Miscellaneous Deductions – If you have debts or child support payments, are they being managed efficiently?

- Loans or Advance Pay Repayments – Did you take a paycheck advance? Make sure you’re not overpaying in fees.

How Adjusting Just One Deduction Could Free Up $6000 A Year

Let’s say you tweak just one deduction—reducing a $250 per paycheck contribution. That frees up:

$500 per month

$6,000 per year

That’s seed money for your business. That’s your marketing budget. That’s new equipment, software, or an extra cushion for slow months.

And the best part? You didn’t work more to get it. You just redirected what was already yours.

How To Take Action & Reclaim Your Money Today

Step 1: Get Your Latest Pay Stub

Most payroll systems let you download it online. Grab the most recent one and look at every deduction listed.

Step 2: Highlight Unnecessary DeductionsAsk yourself:

- Am I overpaying in any category?

- Do these deductions align with my current business and financial priorities?

- Could adjusting my tax withholdings increase my monthly cash flow?

Step 3: Make Small Adjustments

- Update your W-4 if needed (consult a tax professional if unsure)

Lower unnecessary deductions (like excess retirement contributions for now)

Pause contributions if your business urgently needs capital.

Final Thoughts: Your Paycheck, Your Money, Your Power!

For entrepreneurs, cash flow is king. Every dollar that disappears from your paycheck without intention is a dollar that could have been used to grow your business.

So before you stress about needing more income, make sure you’re maximizing what you already have.

💰 Want a free download to see how much money you could be leaving on the table?

Sign up below to get a web-based worksheet and step-by-step video tutorial of how to complete it so you can get your money straight and grow it with strategy.